FY2024 Performance Review

Overall, FY2024 was a solid year. While some deceleration in growth rate was unavoidable given our expanding business scale, net sales still rose steadily, up 27.5% year on year, remaining within the forecast range. Order value, one of our most important KPIs, has continued to set record highs since our founding, and FY2024 was no exception. With high motivation company-wide, we're well-positioned as we enter FY2025.

Adjusted operating profit*1 increased significantly, up 108.0% year on year, driven by strong topline growth and lower cost of sales and SG&A ratios. As a result, we achieved a record-high full-year adjusted operating profit margin of 8.2%. Among SG&A expenses, personnel expenses increased year on year in absolute terms, but the personnel expense ratio to net sales declined by 0.6 pts. Advertising expenses, however, rose because of large-scale promotions, including TV commercials for Sansan, Bill One, and Contract One in the fourth quarter, pushing up the advertising expense ratio 0.2 pts.

In the meeting with investors following the financial results announcement, investors recognized our ability to deliver on the guidance figures as promised. We also sense growing investor awareness that our guidance represents fair figures, rather than conservative estimates.

*1 Operating profit share-based payment expenses + expenses arising from business combinations (amortization of goodwill and amortization of intangible assets)

Review by Solution

In FY2024, all of our solutions achieved steady growth. By strengthening its sales structure and implementing other initiatives, Sansan, the business database, achieved accelerated recurring sales growth, up 16.9% year on year, showing robust growth. The average monthly churn rate for the last 12 months remained low, at 0.49%, well below 1%. We also made steady progress in upselling to existing customers, consistently achieving negative churn*2, in which the increase in revenue from existing subscriptions exceeds the cancellation amount.

Bill One fell slightly short of guidance but still posted strong growth, with net sales up 58.7% year on year. The churn rate remained extremely low, at 0.33%. While the last-minute surge in demand triggered by the implementation of Japan's Invoicing System subsided, and we faced some headwinds in sales, new order value per sales employee settled at a level comparable with that of Sansan, and continued positive growth is expected. In 2024, we added Bill One Expense and Bill One Accounts Receivable. Bill One Expense, in particular, is off to a strong start, steadily acquiring 30-50 new subscriptions per month over the past six months. Bill One has also consistently achieved negative churn. Going forward, we plan to accelerate upselling by offering the three solutions—Bill One Invoice Receive, Bill One Expense, and Bill One Accounts Receivable—as an integrated package.

The Eight Business outperformed expectations the most in FY2024. Multiple factors contributed to this, including the effects of price revisions, driving growth in both B2B and B2C solutions. As a result, net sales were up 42.4% year on year, exceeding guidance. From FY2024, we began allocating corporate expenses to each segment when calculating adjusted operating profit, and even under this framework, the Eight Business achieved profitability on a full-year basis. We regard our being able to achieve both high growth and improved profitability at the same time as a major achievement.

Contract One, launched in 2022, is still small in scale but continued to expand steadily, with net sales up 38.2% and the number of subscriptions up 77.0% year on year. Given a strengthened sales structure and the effects of TV commercials, we expect net sales to grow by more than 70% in FY2025.

*2 A state where the increase in revenue from existing subscriptions exceeds the decrease in revenue due to cancellations

Medium-Term Financial Policy and FY2025 Performance Outlook

In July 2024, we announced our medium-term financial policy, which calls for a three-year compound annual growth rate (CAGR) in net sales of 22–27% through FY2026, with an adjusted operating profit margin of 18–23% in FY2026. We also indicated our long-term aim of achieving an adjusted operating profit margin of 30% or higher. In FY2024, the first year of this medium-term financial policy, we delivered steady results in line with the policy.

We intentionally use the term "medium-term financial policy" to avoid confusion with other companies' "medium-term management plans." Many companies design medium-term business strategies first and then set numerical targets based on them. However, the figures we have presented merely indicate the levels that could be reached in three years if we continue with the current business policies. Therefore, we do not alter business strategies or actions based on these figures, nor do we provide numerical breakdowns by business. They are not used for internal business management either; internally, we aim for even higher target levels.

Our outlook for FY2025, the second year, remains at a steady level in line with the medium-term financial policy, and at this time, we do not plan to revise the numerical targets. Meanwhile, we intend to invest more aggressively in advertising and promotion than originally planned, given the smooth launch of new solutions such as Bill One Expense and Contract One.

Specifically, we forecast net sales to increase 22.0–25.0% year on year. Sansan is expected to continue stable growth of 15.0–17.0%. Bill One is projected to grow around 35.0–40.0%. We continue to expect strong growth with contributions in the second half from sales personnel getting up to speed, among other factors. Eight Business is forecast to increase 27.0–33.0%, with business event solutions and Eight Team driving growth.

Adjusted operating profit is expected to increase significantly, up 92.7–143.0% year on year, supported by steady net sales growth, an improved gross profit margin, and a lower SG&A ratio. Adjusted operating profit margin is forecast to reach double digits for the first time since our founding, at 13.0–16.0%.

In terms of major costs, we plan to restrain recruitment to around 370 new graduates and mid-career hires in total, reflecting improved operational efficiency and productivity driven by AI utilization. As a result, we expect to contain the increase in personnel expenses at about 19%, with the personnel expense ratio to net sales declining. Advertising expenses, however, are expected to increase by about 28% as we carry out more aggressive marketing to maximize sales activities. Consequently, the advertising expense ratio to net sales is expected to rise temporarily.

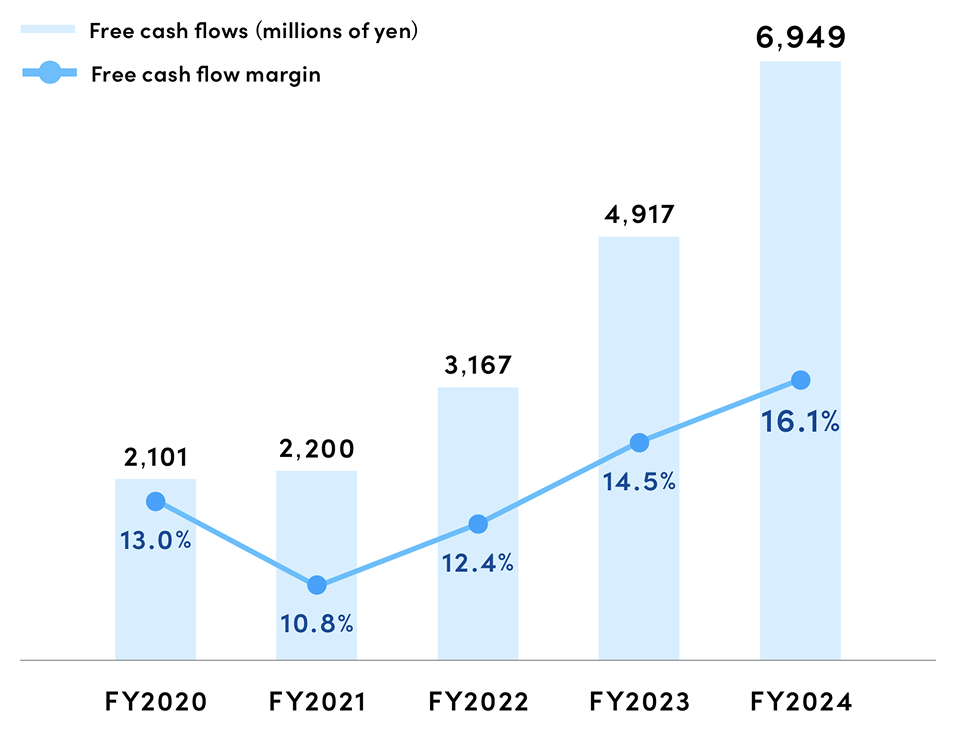

Free Cash Flow *3

*3 Cash flows from operating activities - (Capital expenditures for property, plant and equipment + Capital expenditures for intangible assets)

Risks and Opportunities Under the Medium-Term Financial Policy

Our medium-term financial policy represents the minimum level we must achieve. We believe there is little risk of a significant downside as long as no unforeseen security-related incidents or similar events occur.

However, we expect the accelerated use of AI within the company to have a major positive impact on costs going forward. We are already beginning to see results from improved operational efficiency, and patterns are gradually being visualized that clarify where and how AI can be applied, and thereby, to what extent AI can deliver results. There is a very high likelihood that AI will progressively replace a wide range of internal operations. At that point, strategic decisions will be needed regarding how far to pursue cost reductions and how much of the resulting savings to reinvest in which areas.

Generating Free Cash Flow

Our free cash flow has continued to expand steadily, supported by net sales growth and improvement in the adjusted operating profit margin, reaching 6.9 billion yen in FY2024. Although one-time expenses were incurred for the acquisition of non-current assets associated with our head office relocation, our free cash flow margin still rose 1.6 pts. year on year, to 16.1%, remaining at a highly sound level.

Over the long term, we have consistently secured a free cash flow margin that exceeds the adjusted operating profit margin. We view this as demonstrating our strong cash generation ability, while also providing evidence of the effectiveness of our business and the soundness of our management. Going forward, we intend to maintain and strengthen this level, allowing us to gain greater flexibility for medium-to-long-term growth investments and shareholder returns.

Action to Implement Management That Is Conscious of Cost of Capital and Stock Price

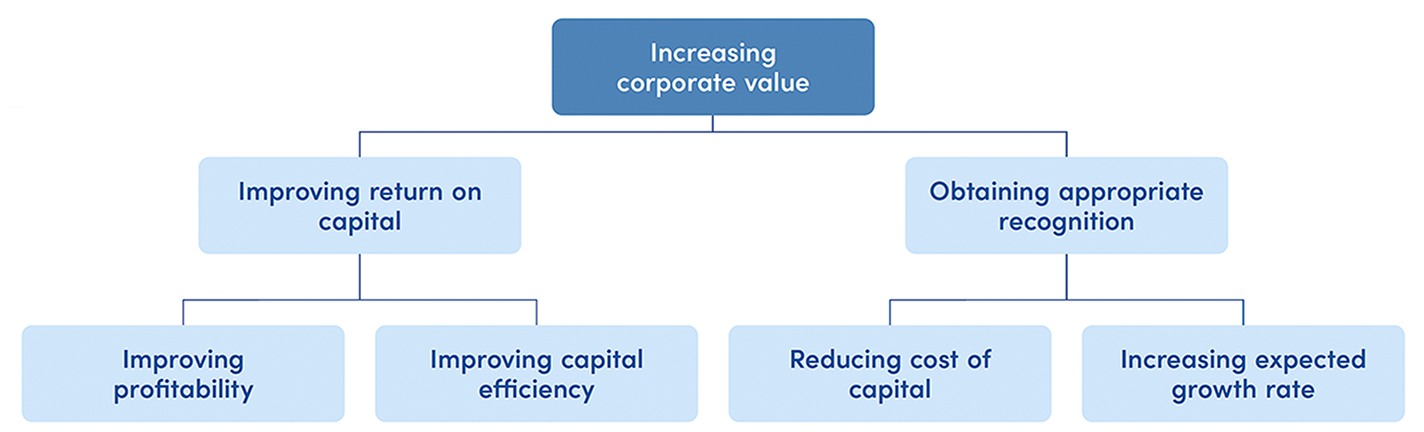

In line with the Tokyo Stock Exchange's guidance, we have formulated our policy for "Action to Implement Management That Is Conscious of Cost of Capital and Stock Price." We have broken down the factors that contribute to improving corporate value into four categories: improving profitability, optimizing capital efficiency, reducing costs of capital, and raising expected growth rates, and have structurally illustrated how our business activities contribute to each factor. We are not yet at the stage of presenting quantitative indicators, but we have clarified our stance of pursuing heightened corporate value while emphasizing constructive engagement with the capital markets—this, in itself, represents a major step forward.

We recognize that costs of capital are at a relatively low level, given our current business structure and financial position. At the same time, we remain mindful of the need to reduce them further. We have maintained good relationships with financial institutions and secured sufficient borrowing capacity to meet our needs. To reduce equity costs, it's also important to minimize the gap between our financial results guidance and actual results.

Looking back over the past five years, our internal net sales plan and actual results diverged by more than 1% on only one occasion. We take pride in this as evidence that a culture of precise planning and disciplined execution is firmly established within the company. We aim to continue providing stable guidance and to deliver on it to further build trust with the capital markets. We also emphasize sustainability initiatives and the disclosure of non-financial information, and we seek to strengthen our standing in the capital markets through dialogue with investors.

Regarding capital efficiency, as a growing company, we have consistently managed our business with a focus on achieving high investment efficiency. The internal hurdle we set for investment efficiency is at a higher level than general standards. From the perspective of financial structure, our equity ratio stood at 31.2% as of the end of FY2024, which is sufficient for promoting our existing businesses. Since our listing, we have not conducted any equity financing and have supported business growth with internally generated funds. While we have issued stock options, we have strengthened corporate value without significantly diluting shareholders' equity, which we regard as a result of management that emphasizes capital efficiency.

Looking ahead to improving capital efficiency, we recognize the importance of considering our capital allocation policy over the medium term and setting quantitative targets. On the premise of expanding free cash flow, we intend to present a clear policy at the appropriate time from the standpoint of improving capital efficiency and maximizing shareholder value. In doing so, maintaining a balance between growth investments and shareholder returns is critical. Given our current growth phase, however, we prioritize the use of funds in the following order: first, creating new businesses, including M&A; second, share buybacks; and third, dividends.

Policy for Action to Implement Management That Is Conscious of Cost of Capital and Stock Price

Growth Investments and M&A

We fund our growth investments by allocating part of the cash generated by Sansan to high-growth businesses: Bill One and Contract One. Recruitment and advertising continue to be the mainstay of our growth investments. When making allocation decisions, we consider key indicators, including productivity and sales efficiency metrics such as new order value per sales employee and customer lifetime value.

We will also consider investments in M&A deals and new business areas on a case by case basis, when attractive opportunities arise. While we do not set predetermined investment limits, the strengthening of our financial structure has made it easier for us to take on larger and higher-risk projects.

Meanwhile, in FY2024, we recorded a loss related to the transfer of Unipos shares. After the investment, we initially expected synergies within the group, but, given delays in monetization and the outcomes of various initiatives, we concluded that sufficient synergies could not be generated. We take this consequence seriously and will evaluate risks more carefully when making investment decisions going forward. In the SaaS domain, our core focus, business developments often assume initial losses, making it difficult to set uniform withdrawal standards. Still, we will apply the lessons learned here to future investment activities.

Regarding M&A, we have a responsibility to provide convincing explanations, both internally and externally, on why we are making a group company and how this will contribute to achieving our vision. A key requirement is that the target company possesses data or technology that can reinforce our core businesses and support achieving our vision.

We also see cultural fit as a critical factor that can determine success or failure. In the post-merger integration (PMI), many issues need to be addressed, but we believe that carefully building the optimal framework, one step at a time and with consideration for each company's culture and talent characteristics, is the key to success.

Shareholder Returns

Maintaining a balance between growth investments and shareholder returns is critical in capital allocation. At present, however, we are in a business expansion phase, and we see strengthening growth investments as ultimately the best way to maximize returns to our shareholders. At the same time, we will continue reviewing the specific shareholder return initiatives we began in FY2024.

We prioritize shareholder returns first in share buybacks and second in dividends. While we carried out share buybacks in FY2024, we have no plans to announce for FY2025 at this stage. That said, our policy of executing buybacks flexibly when necessary remains unchanged.

Our financial structure has been steadily reinforced, with cash on hand reaching approximately 30 billion yen. However, under the Companies Act of Japan, there is a ceiling on shareholder returns, known as the distributable amount. Since the amount is currently relatively small, we face constraints in presenting a quantitative shareholder return policy at this time. Still, we intend to disclose a quantitative policy over the medium term, and we are even more confident in doing so this year than last year.

Financing

Given our cash-on-hand level and our ability to generate sufficient operating cash flow, we believe we have secured sufficient funds for business operations. With improved recognition and credibility, and supported by a sound financial structure including liquidity and robust performance, our financing environment is more favorable than ever.

Although domestic interest rates are gradually trending upward, they currently have little impact on our financing. We also recognize that our balance sheet remains sound. We launched the Bill One Business Card, a corporate credit card, in 2023, and usage continues to expand steadily. However, the buildup of cash on hand from the growth of our core businesses has outpaced the funding needs associated with its usage expansion. As a result, we are able to smoothly advance our business without the need for special financing at this time.

If additional funding needs arise from large M&A deals and other activities in the future, we will flexibly consider the optimal means from among a wide range of options, including borrowings from financial institutions and equity financing. To this end, we will continue to cultivate good relationships with financial institutions.

Strengthening Corporate Governance and Ensuring Compliance

As the material issue owner, I am responsible for the following material issues: strengthening corporate governance and ensuring compliance.

Since corporate governance is an area with no definitive goal, we focus on steadily advancing it step by step. In FY2024, we strengthened the supervisory and monitoring functions of the Board of Directors by changing the ratio of outside to internal Directors from 4:5 to 5:5. In addition, following the announcement of our medium-term financial policy, we incorporated adjusted operating profit, in addition to net sales, as an evaluation indicator in the performance-linked compensation system for Directors.

Regarding compliance, we implemented initiatives to raise awareness of our whistleblower hotline. The number of whistleblowing reports resultantly increased, but we view this as a positive outcome of greater awareness. At the same time, society has seen various cases of governance failures related to information security and respect for human rights. We strive to learn from such cases at other firms rather than just treating them as cautionary tales, reviewing and inspecting our own systems in light of them, and applying the lessons learned to practice.

Our Philosophy

We aim to realize our vision to "Become business infrastructure," under our mission of "Turning encounters into innovation." While we are still only partway along this journey, as we continue to grow into a larger presence, we will draw closer to being recognized as business infrastructure in society and the marketplace.

As CFO, net sales growth is the indicator I emphasize most in achieving this vision. To truly become a company worthy of being called infrastructure, it's essential to deliver the value of our solutions widely across society and steadily expand net sales. To support this growth, we strategically design our capital allocation and investment decisions in alignment with our medium-term financial policy.

However, expanding net sales alone is not enough. Winning greater recognition in the capital markets is also essential for establishing our position as business infrastructure. In FY2024, we set out initiatives for "Action to Implement Management That is Conscious of Cost of Capital and Stock Price." By steadily executing these initiatives, we will continue to strengthen corporate value and build trust with the capital markets. When making decisions on capital structure, such as establishing group companies or pursuing M&A deals, we always ask whether these initiatives contribute to our corporate purpose.

Our mission and vision are not just slogans, they only have meaning when they are truly embedded in the organization. My role is to support these principles financially while maintaining a balance between growth, profitability, and soundness. At the same time, I deeply share in our collective drive to move forward as one company with a clear mission and to find great fulfillment in it. As CFO, I am fully committed to realizing this mission and vision.

To Our Stakeholders

The number of investor meetings has continued to grow each year and we are steadily broadening our investor base to reach new segments. We are witnessing increasing diversification across both geographical and demographic dimensions. Particularly, since announcing our medium-term financial policy last year, I have seen substantially deeper dialogue with stakeholders.

However, I remain firmly convinced that our stock is undervalued. There is a clear gap between the growth trajectory we envision and the evaluation from the capital markets. I am continually examining the underlying factors behind this disconnect.

Some overseas investors believe that "business cards will eventually disappear." I tell them that even if business cards become obsolete, when people think about how to exchange contact information in the future, they will come to see Sansan as the most convenient solution. Yet, I often face considerable barriers merely in capturing their initial interest.

In contrast, domestic investors recognize that "business cards are still widely used." Still, unless benchmarked properly against global SaaS companies, it can take considerable time for them to fully appreciate how exceptional our low churn rate is and how profoundly this supports our future profitability and cash flow stability.

Bridging these gaps, one by one, is at the core of my role as CFO. It's about communicating the fundamental value of our business to stakeholders and building trust with the capital markets. I am firmly convinced that this cumulative effort will ultimately drive the sustainable strengthening of corporate value. I remain committed to actively deepening our dialogue with stakeholders and steadfastly pursuing the maximization of corporate value.

Director, Executive Officer, CFO

Muneyuki Hashimoto