1. Basic Policy of Information Disclosure

Our basic IR policy is to conduct correct, fair and timely information disclosure to our stakeholders, including shareholders and investors, in accordance with the Financial Instruments and Exchange Act and other relevant laws and the rules for the timely disclosure of issuers of listed securities as defined by the Tokyo Stock Exchange (hereafter “timely disclosure rules”), as well as in accordance with the purpose of our Corporate Governance Code.

2. Subject Disclosure Information and Actions

The Company systematically categorizes material information to be disclosed as shown below and discloses it based on appropriate standards.

- Statutory disclosure information: Disclosure information required by the Financial Instruments and Exchange Act, Companies Act and other laws and regulations, such as securities reports, semi-annual reports, tentative reports, etc.

- Timely disclosure information: Information that may have an important influence on the investment decisions of investors, as defined in the timely disclosure rules by the Tokyo Stock Exchange, such as facts of determination, facts of occurrence and financial information.

- Voluntary disclosure information: Information judged to be useful for shareholders and investors in understanding the Company, although it is not covered in laws and regulations or the timely disclosure rules, such as medium-term financial policies, ESG-related information and annual reports.

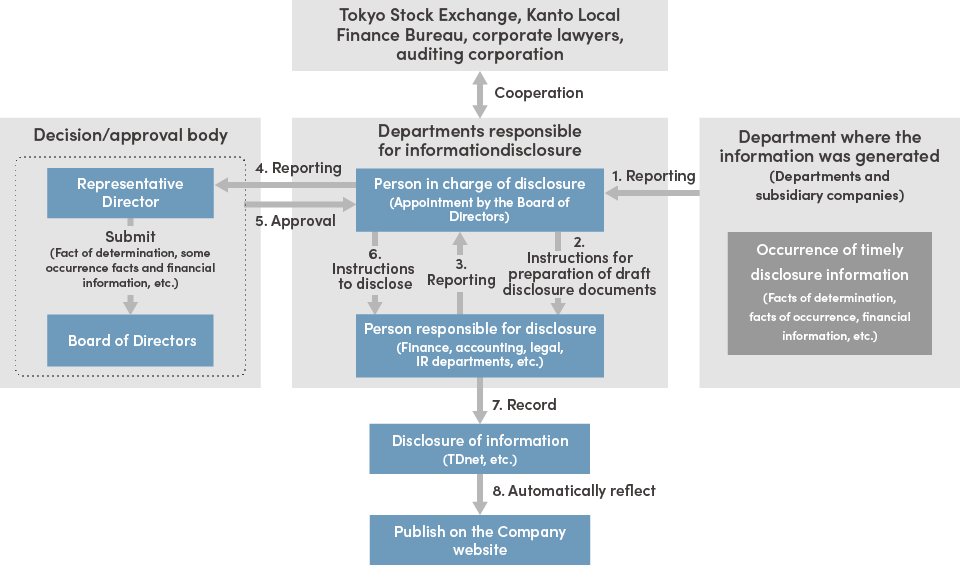

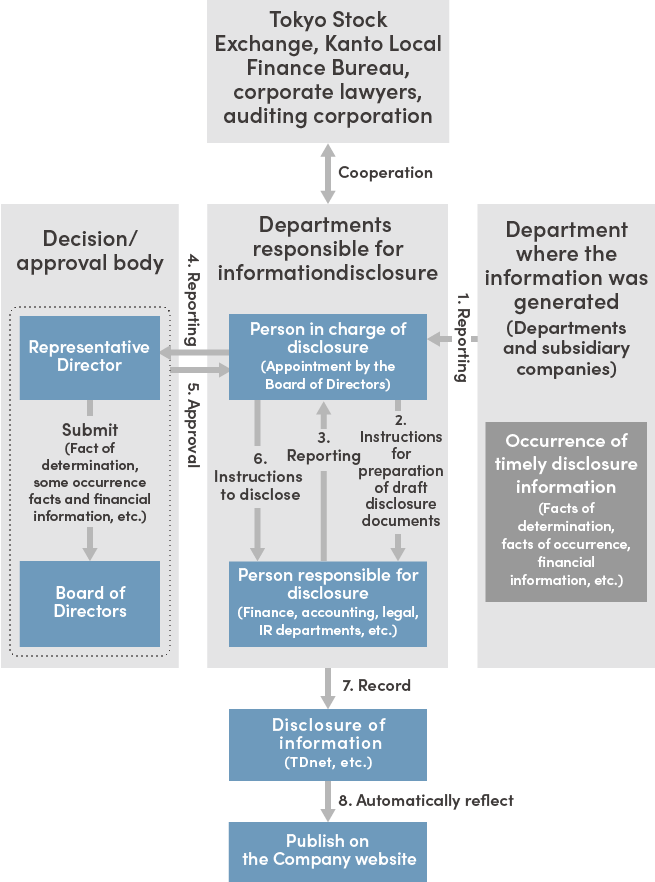

3. Information Disclosure System

In order to ensure timely, proper and fair information disclosure, the Company clarifies persons responsible for information disclosure and creates a system for correct information gathering and disclosure through coordination with the relevant departments.

4. Methods of Information Disclosure

The disclosure of information for which the timely disclosure rules of the Tokyo Stock Exchange apply will be disclosed on the Timely Disclosure network (TDnet) operated by the Exchange, and in principle will be posted promptly on our IR site. Even after posting on TDnet, the Company strives to provide easier-to-understand information by enriching the content of the IR site. Other information which does not fall under the timely disclosure rules but which is considered important for shareholders to understand the Company will be actively disclosed through the IR site.

5. Quiet period

To prevent the leakage of financial information and secure fairness, a quiet period will be held during one month before the date of the announcement of financial results. During this period, we will refrain from commenting or answering questions regarding our financial results. However, even during the quiet period, if there are important facts that fall under the timely disclosure rules, we will disclose such information immediately in accordance with the purpose of timely disclosure.

6. Dialogue with Shareholders and Investors

Aiming for sustainable growth and long-term enhancement of corporate value, the Company is working to promote constructive dialogue with shareholders and investors.

For sustainable growth and long-term enhancement of corporate value, the Company is working to promote constructive dialogue with stakeholders and investors. The department in charge of IR, supervised by the officer who is Director, Executive Officer and CFO, engages in communication with shareholders and investors as a main spokesperson in our IR activities. To enhance opportunities for dialogue, the Company holds regular briefings for analysts, institutional investors, and individual investors, and arranges one-on-one meetings. In addition, the Company strives to gain a comprehensive understanding of our shareholder structure and regularly provides feedback to the Board of Directors and management meetings regarding the opinions, expectations and concerns received through dialogue. This feedback is used to inform management decisions aimed at enhancing corporate value. The Company also actively discloses non-financial information, including ESG and sustainability-related data, to help investors gain a deeper understanding of the Company.

7. Proper Control of Insider Information

To properly manage insider information, the Company has established timely disclosure rules and insider trading management rules and strictly manages insider information in accordance with the provisions of those rules.