Turning encounters into innovation

Our world has always been driven by encounters. People encounter people.

Companies encounter companies. These chains of encounters move society forward.

We rediscover the potential of every encounter and transform it into unique business data.

That data sparks new encounters that lead to innovation, and it becomes the basis for entirely new ways of working.

Unrestricted by the accepted ways of doing each task and process, we reshape what’s taken for granted in business.

Become business infrastructure

Face your mission and love your work

Lead the customer

Anticipate the experience

Make decisions with determination and intent

Find a faster way

Growth Mindset

Appreciate and be inspired

Don’t fear change, and challenge yourself

Balancing security and convenience

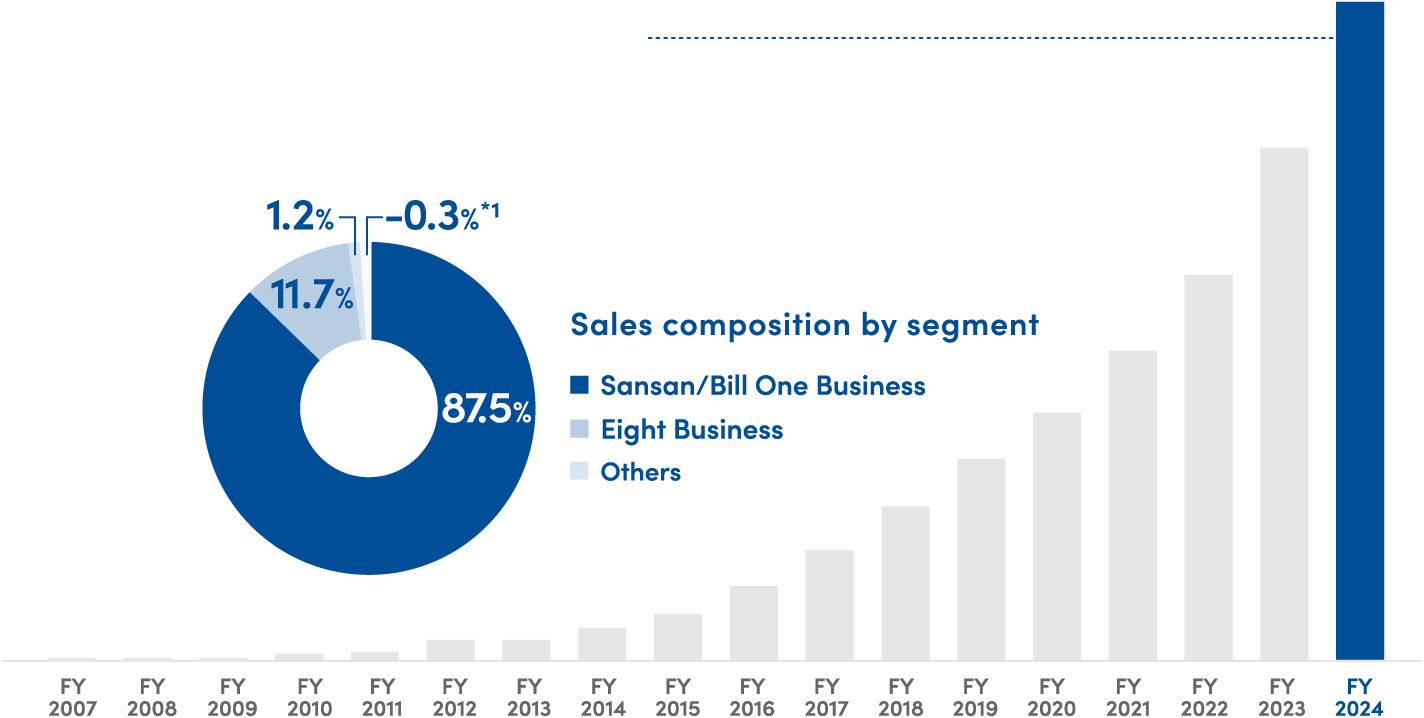

¥43,202mn

Net sales

¥43,202mn

(5-year CAGR*2: 26.5%)

Adjusted operating profit *3

¥3,555mn

(5-year CAGR *2: 36.2%)

Adjusted operating profit margin

8.2%

ARR *4

¥41,591mn

Free cash flow *5

¥6,949mn

Employees

2,235people

*1 Adjusts (inter-segment sales or transfer)

*2 Compound Annual Growth Rate

*3 Operating profit + share-based payment expenses + expenses arising from business combinations (amortization of goodwill and amortization of intangible assets)

*4 Annual Recurring Revenue

*5 Cash flows from operating activities –(capital expenditures for property, plant and equipment + capital expenditures for intangible assets)

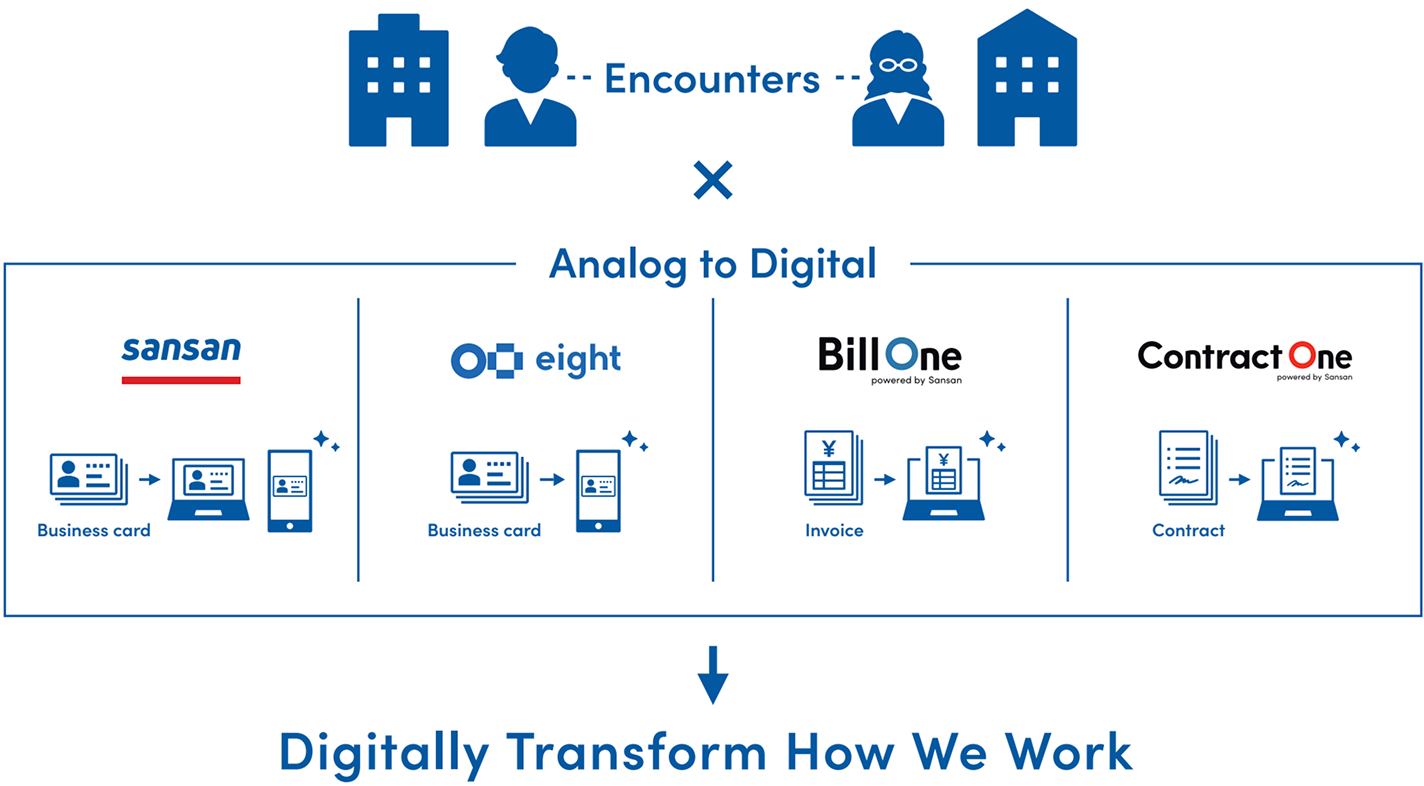

The Sansan Group focuses on business encounters among people and companies and provides AI transformation (AX) solutions that turn these encounters into business opportunities and reshape how people work.

We apply our proprietary technology and high-level security for digitizing business cards, invoices, contracts, and other forms of analog information to build databases as our ecosystem boosts operational efficiency and productivity at user companies.

Our solutions are mainly offered as cloud-based software for companies and available by recurring subscription.

Sansan is the business database that centralizes business card and contact data, corporate information, and sales history, as users build a unique, shareable, internal repository that uncovers sales opportunities and reduces costs.

FY2024

|

Bill One is a cloud-based solution that receives and digitizes all invoices, accelerating company-wide invoice management.

*Contents may differ from services offered outside Japan.

FY2024

|

Contract One is the business transaction management solution that digitizes contracts and other relevant documentation. It visualizes transaction terms and changes to prevent missed opportunities and loss of trust, while controlling corporate profits.

FY2024

|

Eight is an app that lets you easily share your Virtual Card with anyone and automatically stay updated on your contacts’ career moves.

FY2024

|

*1 Monthly recurring revenue per subscription

*2 Percentage of monthly recurring revenue that decreased due to cancellation among monthly recurring revenue from existing subscriptions

*3 Net sales for the overall Eight business

*4 Service that enables sharing of business cards in a company

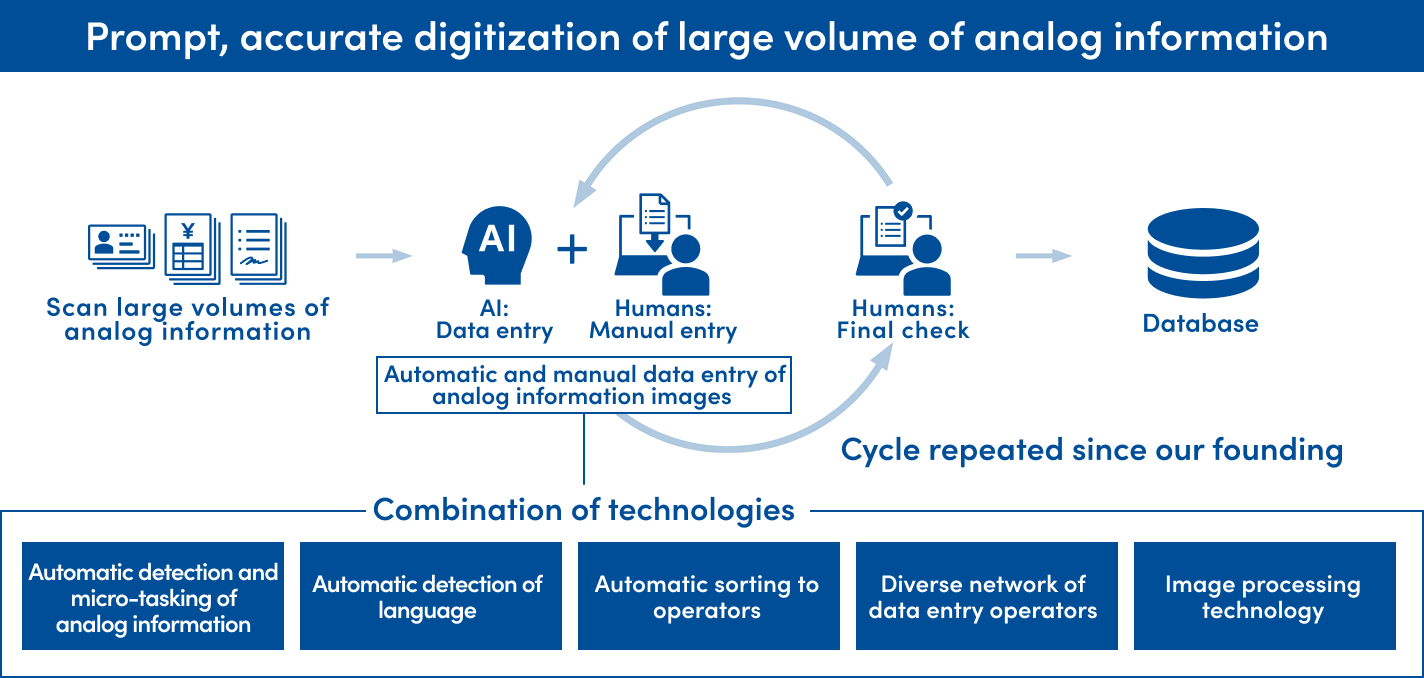

The Sansan Group’s various strengths include strong brand recognition in Japan and deep sales and marketing expertise, and its unique system and technologies that digitize analog information quickly and accurately create major competitive advantages.

Technology alone cannot deliver accurate digitization, so we combine manual entry with technology to handle digitization across areas such as business cards and contacts, invoices, and contracts.

We have pursued accurate digitization supported by humans since our founding, and advances in machine learning and other AI now increase digitization speed and reduce costs.

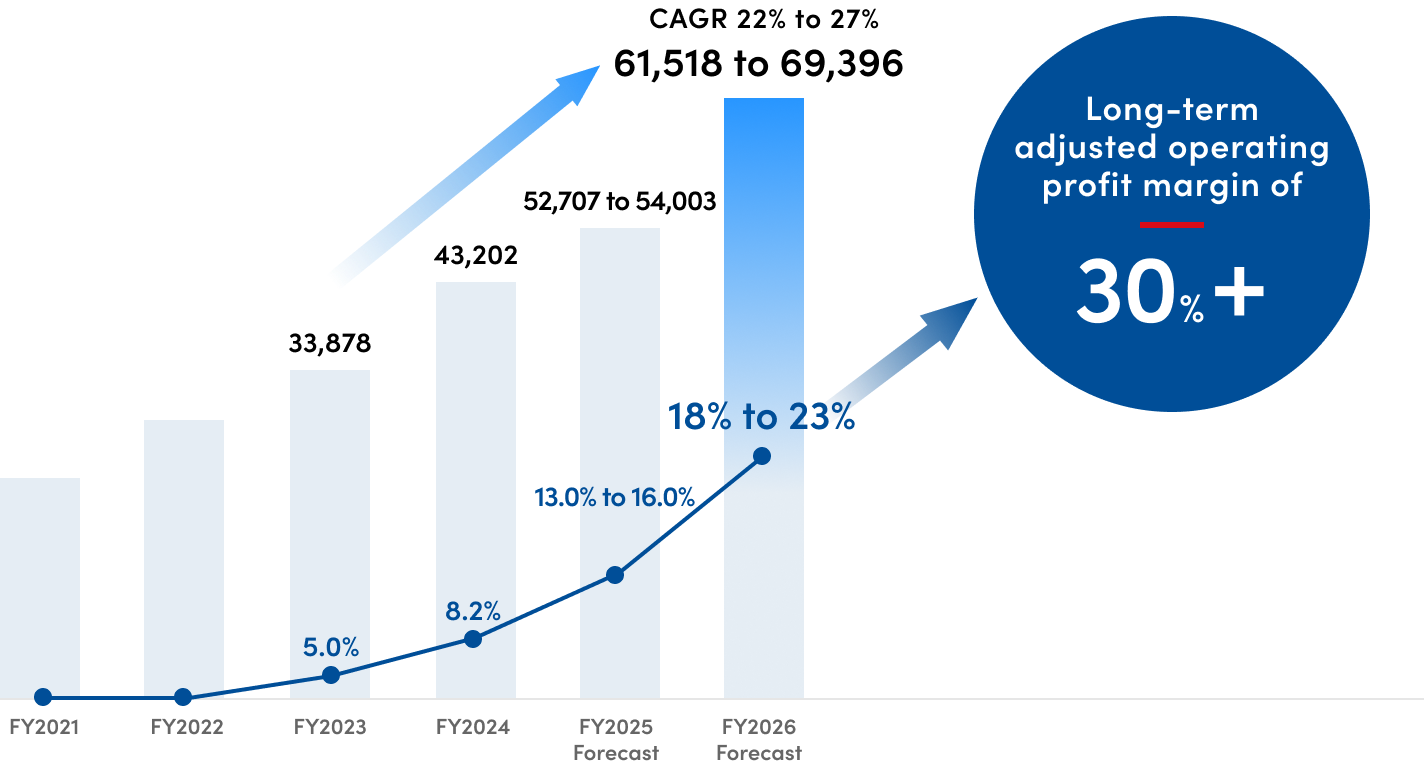

In our medium-term financial policy, we aim for continued steady growth of net sales and accelerated growth of adjusted operating profit margin from FY2024 to FY2026.

For net sales, the most important management indicator, we aim for a three-year CAGR of 22–27%. For adjusted operating profit margin, we are accelerating growth while making investments for growth of net sales in each fiscal year and aiming for a profit margin of 18–23% in FY2026 and 30%+ over the long term.